Company shares

Company shares represent ownership in a company. Any company can decide to sell its rights of ownership to the public using shares. Buy buying those shares, the public contributes to the capital of the company. In return, they are entitled to share the profits the company makes and can admit to rights of ownership by participating in decision making, etc.

A person who buys these shares is called a shareholder and can buy from one up to many numbers of shares. A relatively new company will have typically about 1000 shares but can also choose to have more or less depending on various factors.

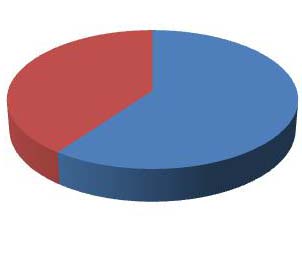

The amount of power a share holder has depends on the number of company shares he or she has. The greater the number of shares, the greater is the role of the share holder in decision making. The percentage of the profits, known as dividends that the share holder gets also increases with increase in number of shares. However in case of losses, the share holder with greatest number of shares tends to loose more. If a corporation has a number of shareholders all with the exact same number of shares, then they enjoy the same amount of power as well as responsibility.

In South Africa there are three types of company shares. The first type is the common voting share that gives the holder the right to participate in decision making and shaping the policies of the company. Such a share holder is usually a part of the board of directors and is involved directly in running the company. The second type is the preferred non-voting shares.

Such a share holder cannot interfere with the policies of the company and has no voting rights such as voting in a board meeting. However they still get to enjoy the profits that the company makes. The third type that is not so common is the income splitting shares. Such share holders do not have voting rights and are also only entitled to the profit percentage that the board of directors decides on.

A company share can be bought by anybody including employees who work for the company. The dividends, that the shareholder is entitled to, can be decided only by the board of directors. Sometimes the board of directors can simply choose not give the dividends to the share holders for a particular year or can choose to lower the dividends. This depends on the amount of profit that the company makes.

Company shares in a private limited company vary from other types due to the fact that they cannot be sold off or transferred to anybody else without prior permission from its directors. In such companies, the shares are usually, though not always, divided among the employees and family members.

The Canadian stock market in Toronto is one of the primary trading centres that play a major role in domestic as well as multinational companies. Investing in such stocks is a good way to make some easy profits. By carefully analysis, you can find out where all the money is and secure your financial future!