6 Reasons to start saving

We all like having a few extra Rands in our wallets, but reality is, those extra Rands don’t just miraculously end up in your wallet. You need to work at putting them aside so that you can enjoy the benefits. Here’s a few reasons how and why to do it.

Save for emergencies:

You should always have an emergency fund that will help sustain your life should you be unemployed for a few months. In another case if your car breaks down, it doesn’t need to break your bank account. Life is unpredictable, but your pockets should at least be prepared.

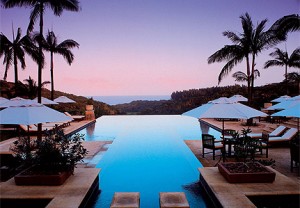

Luxuries:

Luxuries:

One of the best reasons to start saving is for that holiday you’ve always wanted to go on but could never afford.

Caring for your elderly parents:

Not everyone is lucky enough as an adult to still have their parents alive. For those who do, taking care of them from your savings would be much better than doing it from your monthly salary. This way it won’t feel like a hassle or a burden because you will be prepared for it.

Buying our first everything:

Buying our first everything:

When you get that first job all you think of is the independence that will come with it. Like getting your fist car or moving into your own place. Saving towards that will make it much easier considering deposits and the likes.

Furthering your education:

As much you may be educated enough to earn your spot in the corporate world, furthering your education is always a good idea. It’s even better if you money set aside to do so instead of accumulating debt with a study loan.

Medical emergencies:

Hospitals can be very costly especially if you want proper medical care. Should something happen to you then you will be covered and your family won’t be left struggling to gather money for your hospital bills.

The best way to actually save is to set your priorities. List means drawing up a monthly budget to outline what you need and what you can do without, do it. The benefits are amazing, but just like everything else in life, it takes time.

Mbali Radebe