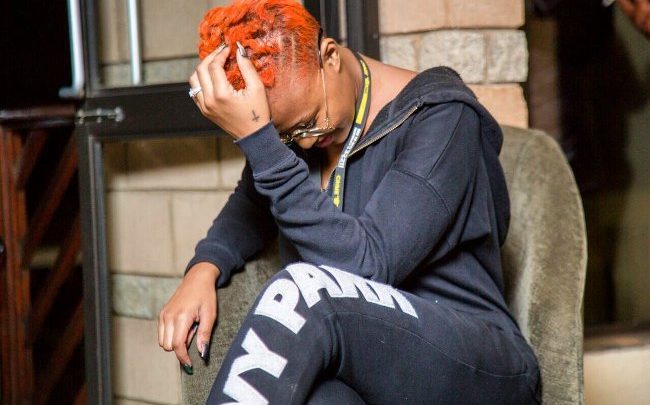

Babes Wodumo’s Engagement Speculations Intensify

Babes Wodumo’s Engagement Speculations Intensify. Once again she is spotted with that huge rock on her ring finger. Monday night on Home Ground show, the talented musician once again flaunted her ring. Sharing a picture of her and Minnie Dlamini, she said, “yessss girl let’s wear that bling.” Many once again went back to the engagement speculations, asking i someone put a ring on it.

https://www.instagram.com/p/BhYuyOblOJ4/?taken-by=babes_wodumo

This comes after Babes and her family denied any engagement. Her father made it very clear that according to him Babes was neither engaged nor married because in his culture a man’s family needs to ask for the bride in a lobola ceremony and that hasn’t yet happened. Whereas Babes said its just swag. We are watching the space.